🍟 8/2/2021 – Fuzzy’s Taco Shop And Row House

Today’s edition highlights Fuzzy’s Taco Shop, a baja style Mexican restaurant, and Row House, a boutique fitness concept.

Fuzzy’s Taco Shop was founded in Dallas, Texas in 2003, and started franchising in 2009. The restaurant has a welcoming vibe, a pet friendly atmosphere, and a drink menu that will make your memory fuzzier than the restaurant!

Row House was founded in New York City in 2014, and is built around the idea that rowing is an efficient, low-impact, high-energy, full-body workout for any fitness level. After starting franchising in 2017, the brand was acquired in 2018 by Xponential Fitness, the monster holding company of other fitness franchises like Club Pilates, YogaSix, CycleBar, and more.

The breakdowns are below 👇

Fuzzy’s Taco Shop

Background

- 29.5k Instagram followers

- Founded in 2003, franchising since 2009

- Serves tacos, burritos, nachos, quesadillas, grilled sandwiches, salads and breakfast dishes

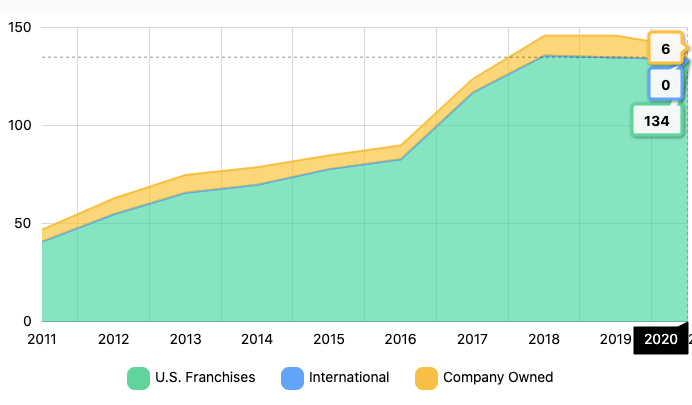

Number of Units

- 140 locations as of 2020, +12.9% growth from 2017-2020

Source: Entrepreneur.com

Fees, Expenses (2020 FDD)

- Initial franchise fee: $35,000

- Brand Development Fund: 2% of gross sales

- Royalty Fee: 3.5% of gross sales in year one, 5% all subsequent years

Initial Investment (2020 FDD)

- Traditional Location: $770,500 – $1,116,500

- Non-Traditional Location (Taqueria): $352,500 – $730,000

Note: a traditional location occupies 3,000 – 4,000 square feet, while the Taqueria model occupies 1,000 – 1,500 square feet.

Financial Performance (2020 FDD)

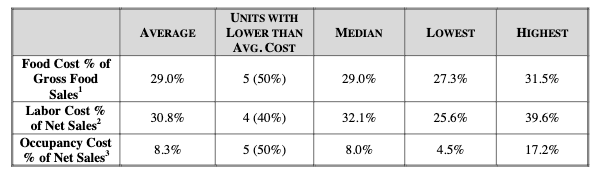

2019 Fiscal Year Performance (all system reporting units are Traditional restaurants):

- Of the above reporting units, 124 were franchised restaurants, and 10 were company owned

2019 Fiscal Year, Company-Owned Locations Operational Costs:

The Wolf’s Take 🍟

Unfortunately, the Franchise Disclosure Document doesn’t provide EBITDA, but the highlights are median franchisee revenue of $1,350,555, and prime costs (labor + COGS) of company owned locations landing at 59.8% of revenue.

Adding prime and occupancy costs, then including your royalty (5% fully ramped), brand fund (2%), and miscellaneous expenses, it’s not crazy to think franchisees are taking home 16%-20% of their revenue, assuming their labor and COGS are similar to the franchisor owned locations.

16%-20% income from $1,350,555 in revenue isn’t a bad potential return. Keep in mind that a serious potential buyer of this brand would be given the contact info for existing franchisees, meaning you’d be able to get a good sense directly from a current owner on just how profitable their locations are.

Recent Press

- Fuzzy’s Taco Shop To Open First Wyoming Location

- Fuzzy’s Taco Shop and OrangeTheory Share Pandemic Insight

Row House

Background

- Rowing workouts are completed in 45 minutes

- Founded in 2014 in New York City, started franchising in 2017

- Acquired in 2018 by boutique fitness holding company, Xponential Fitness

Number of Units

- 94 units as of 2021

Source: Entrepreneur.com

Fees, Expenses (2020 FDD)

- Franchise Fee: $60,000

- Royalty: 7% of gross sales

- Brand Development Fund: 2% of gross sales

Initial Investment (2020 FDD)

- $276,600 – $499,500

- Leasehold improvements make up $35,000 – $158,000 of this range

Financial Performance (2020 FDD)

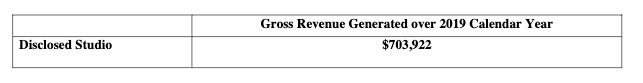

Performance of one franchised location, open the full year 2019:

The Wolf’s Take 🍟

The chart above is the only hard data provided by Row House in the financials. Although they had 51 franchised studios that operated in 2019, the reporting studio was the only location open the full year.

Remember, the FDD doesn’t always tell the full picture. Sometimes a brand has stronger financials than represented, and plenty of times franchises will omit information because they know their numbers just aren’t that compelling. When it comes to Row House, I’d guess it’s the former and not the latter. Why?

They’ve had explosive franchise growth even through covid, and let’s remember who acquired them: Xponential Fitness. Xponential has an extremely impressive portfolio of brands, and they wouldn’t put up the capital for a brand so young if they didn’t see large growth potential.

If you’re interested in operating a fitness concept, this is a brand worth exploring.

Recent Press

Disclaimer: This Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All Content in this email is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the email constitutes professional and/or financial advice, nor does any information in the email constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content in this email before making any decisions based on such information or other Content.