🍟 9/19/2022 – Potbelly Goes All In On Franchising

DEEP DIVE

Potbelly Is Franchising – Yay or Nay?

Regardless of if you’re interested in food franchises or not, this is a worthwhile read for every franchise investor and operator.

Potbelly, the publicly traded fast-casual restaurant chain with a $145 million market cap, recently announced they’re pivoting hard to a franchise strategy.

The brand known for serving sub sandwiches and milkshakes (odd combo, but hey, they’re tasty so who cares?!) has 445+ locations, of which just ~9% are currently owned by franchisees.

So the questions are:

- Why are they franchising?

- Should you be excited?

Speaking to the 2nd question, you’d be right to assume the answer is probably a resounding yes.

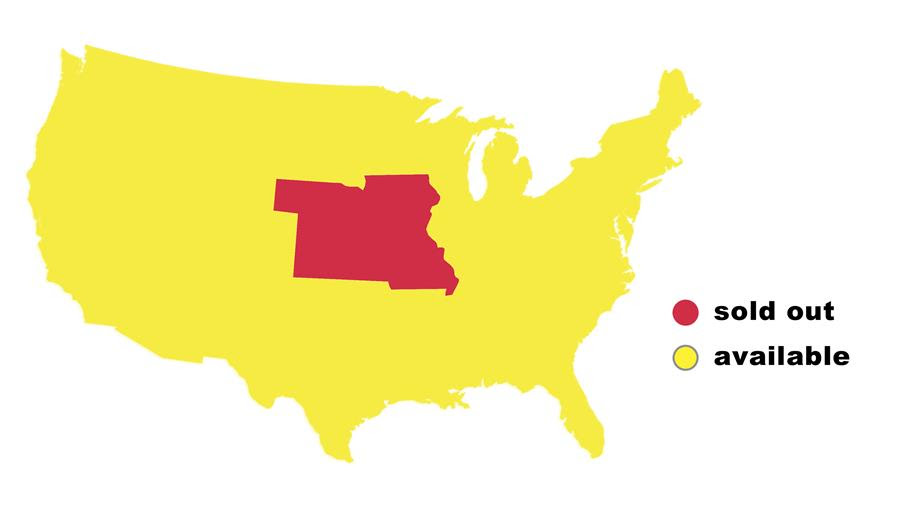

After all, it’s a nationally known restaurant chain with a great product, the resources of a publicly traded company, and a ton of territory available for incoming franchisees.

On the surface, this looks like a rare opportunity. Typically, if there’s tons of available territory, it’s because the brand is emerging and thus isn’t super well known. On the flip side, if a brand is well established, territory is sparse and has already been bought out.

Potbelly seems to be offering the best of both worlds, right?!

Hint: I don’t think so. Unfortunately, it looks like another example of a lot of hype, but little substance and value for franchise owners.

Let’s dig in..

The Why

The why is obvious – franchising will allow Potbelly to scale quicker. They’ve set a goal of reaching 2,000 total units in the next 8-10 years, with 85% of those units being franchised.

To kickstart this initiative, they’re re-franchising (aka selling corporate stores to franchise operators) 25% of their restaurants, while aiming for 10% annual new unit growth through 2024, with higher growth goals beyond that.

All of this is coinciding with the revamp of their digital tech stack, including a new & improved app, and an improved loyalty program to reduce friction for customers and drive revenue for stores.

Why I’m NOT Excited

When I read this via a sponsored article on Franchise Times, I was initially PUMPED. My Wolf senses were tingling, because as I mentioned earlier, it had all the makings of a great franchise opportunity:

- Established brand

- Tons of white space

- (Presumably) deep support + resources

Not to mention they boasted an average unit volume of over $1 million based on 371 restaurants in 2021!

But…revenue isn’t the best indicator of success, especially when it comes to food concepts where margins are slim! As an FYI, according to Toast, the average restaurant profit margin is just 3-5%. Restaurant franchises have to outperform this, as royalties and brand fund fees dilute those profit margins.

Quick intermission: If you want to discover emerging food franchises that are greatly outperforming that average profit margin, sign up for the free pitch party on September 28th!

Based on my own research, the top food franchises are typically offering 10-15% EBITDA margins after all fees are accounted for. So as I dug into the Potbelly FDD, I expected to see something similar, but here’s what I found…

The above table displays the performance of 371 corporate Potbelly restaurants in 2021.

Things look great at first glance:

- Average Revenue over $1M ✅

- Average Shop Profit of $118,908 ✅

Shop profit of $118,908 looks great! But oh wait…let’s add marketing expenses (local marketing + brand fund fees combined) and the royalties.

Note: the corporate locations do not pay these fees, but to comply with regulations, franchises will add in these expenses to match what a franchisee would have to pay.

The math shakes out to a “Shop Profit” of $11,351 after royalties and marketing expenses!

Given the investment is $549,950 – $899,700, that means that even if it only costs you the absolute lowest dollar amount (~$550K) to open a Potbelly, that it would take ~48 years to recoup that investment 🤯!

Forty. Eight. Years.

Not exactly the ROI you were expecting, right?

The Lesson

Avoid the hype, and invest with your brain, not your heart.

Believe me, this was not a fun discovery. Their chicken club sandwich has a special place in MY heart (and, upon numerous lunches over the years, in my stomach), but you can’t lead with emotion when buying a franchise.

This breakdown has no vindictive motive, and is nothing personal. I’m a customer of Potbelly and am rooting for them. But I see this far too often in franchising – where brands throw around average unit volumes, and boast about anything ranging from their tech stack, to marketing playbook, to customer reviews.

But guess what? If there isn’t profitability for you as a franchisee, nothing else matters!

The franchisees are the ones taking the most risk, and they deserve the chance at seeing a return on their investment and changing their lives financially.

I’m not saying that it’s impossible with Potbelly, or that things won’t improve over time.

But when it comes to investing in a franchise, it’s a dangerous game to assume that you’ll perform above the average. And I don’t know about you, but for me, 371 locations nationwide is enough proof of concept to have an idea of the revenue range you’ll fall into (and therefore, profitability).

So whether it’s Potbelly, or another franchise boasting tons of unit growth, don’t get sucked into the hype cycle.

Invest with your brain, not your heart.

Have a great week y’all 🐺🐺

FRANCHISE HEADLINES

Neighborly Hits 30-Brand Milestone

Neighborly, the holding company that specializes in home-services franchises, just acquired Lawn Pride, making it the 30th brand under their umbrella. This means Neighblory now has more than 5K franchise territories in operation – a massive jump from 8 years ago when they just had 7 brands and a few hundred territories.

The success of Neighborly’s acquisition strategy is impressive, and given the succes, I suspect we’ll see private equity firms emulate this across different industries over the next decade.

Nostalgia Warning: Blockbuster’s Demise

Remember hitting Blockbuster on a Friday evening, walking around the store, fully surrounded by the worlds greatest movies? Yeah, so do I 😢. We all know that Netflix is partially responsible for their demise, but did you know that Blockbuster attempted to launch streaming as early as 2000, while Netflix didn’t launch their streaming service until 2007?

The Blockbuster downfall didn’t happen because of a lack of foresight.l If you want to read what really happened, check out my latest on twitter.

Disclaimer: This Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All Content in this email is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the email constitutes professional and/or financial advice, nor does any information in the email constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content in this email before making any decisions based on such information or other Content.